Developing an Operating model to disrupt the Financial sector

CLIENT

Fnality

ABOUT THE PROJECT

Fnality approached Enfuse with a unique challenge. We were asked to design their operating model; an operating model for a business that did not yet provide a product or service and had no competitor or easy comparator. Not only is their business highly unique, but as a challenger business, a simple model would not work. It had to be cutting edge.

THE CHALLENGE

Fnality is a Fintech start-up whose goal is to enable banks to pay each other seamlessly, quickly and securely, removing notable challenges in the current banking model (monstrously time-consuming and costly ones) by utilising blockchain technology. Sounds like a big ask but they have the brains and the backing to do it. This is proven by their top-tier investor base; Fnality has been backed by 15 of the largest financial institutions including Barclays, Nasdaq, UBS and more.

Fnality needed support in developing an operating model which they could then use as a blue print to build out their business. It needed to detail their business architecture so that they could set up the appropriate legal entities with the right capabilities. This was done in parallel with Fnality further defining their products and services and the legal and regulatory implications.

As a global business, Fnality needed a model that would demonstrate to central banks and regulators across multiple jurisdictions that they could operate globally whilst adhering to local legislation and regulations. This is highly complex given the differing international needs. For example, the financial laws governing GBP are set by the Bank of England, whilst the US Dollar is governed by the Federal Reserve. Two very different regulators with completely different laws. This had implications on what and how Fnality could operate, sometimes with notable differences by jurisdiction.

THE ENFUSE APPROACH

Enfuse worked closely with the senior leadership team to develop a framework for the operating model that could articulate what the Fnality business did, and the capabilities it would have to do this. This involved a series of workshops, targeted objective-driven interviews and desk work, with the following key outputs:

Clarified legal entity structures and terminology: We worked through the purpose, products and services for Fnality and used this to clarify the legal entities that would make up Fnality and its third-party ecosystem (central banks, local dev partners etc). This was the ‘framework.’

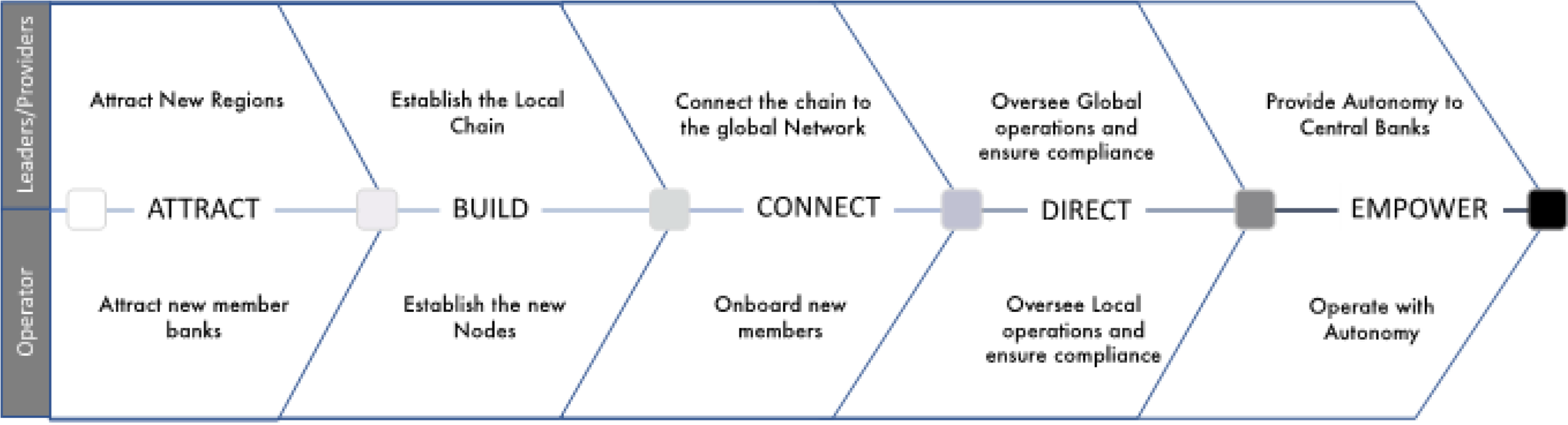

Agreed the value chain: We mapped out the key steps for Fnality to deliver value. This helped bring the business to life, and gave us further clarity for our operating model framework

Defined and mapped the needed capabilities and activities: With the relevant subject matter experts from Fnality, we captured a full list of capabilities and sub activities that they would need, mapping this to the legal entities and the value chain. This gave a firm picture of what would sit where, and where there would be clear touch points between teams and legal entities. It also allowed the Fnality leadership team to clarify where the division of accountabilities would sit, ensuring that they were aligned with the different legal and regulatory needs per jurisdiction

Value Proposition

THE OUTCOMES

Once the entities were theorised, we designed and defined the:

Organisational hierarchy and capabilities for each entity (capabilities which must be fulfilled)

Auditing process; the identification of what each product, suite or guild should be achieving or fulfilling whilst providing proof of control & governance for regulatory bodies

Outsourcing opportunities; identifying which capabilities can be outsourced to service providers/third parties

Value Chain; distinguishing between customer facing and internal capabilities as well as operational, management and supporting services

Products; identifying the core components and capabilities for the range of Products provided by Fnality

As a result of the work we did, Fnality have been able to establish their entity structure, plan & execute against their capabilities and create a leading disruptive technology (of which its POC succeeded) which could be set to take the financial world by storm.